CORAL™ TradeAML

Trade Anti Money Laundering

CORAL™ TradeAML - Trade Anti Money Laundering

CORAL™ TradeAML – was first launched in 2018 and was awarded with FinTech Award in Hong Kong ICT Awards 2019.

A real time Trade Anti Money Laundering screening process with a structured host of analysis, monitoring, checks and reporting. The detailed on-going screenings and enhanced transaction monitoring covers a step by step approach of evaluating trade transactions that enables detection of TBML schemes. This accurate and efficient automated process ensures legitimate trade continues to flow and halts fraudulent ones.

CORAL™ TradeAML assists in establishing clearer and effective gateways with appropriate controls and safeguards the existing legal frameworks to facilitate the effectiveness in exchanging of trade data and other relevant information in effort to combat financial crime, while ensuring commerce through trade continues to flow in an efficient manner.

The solution automates trade finance data digitization, verification, auto labelling, screening alerts, document image processing, document categorization, fields identification, compliance checks, red flags, consistency check, text reconciliation, allowing your organization to:

- Automate and digitize trade transaction data

- Perform frictionless AML compliance checks

- Automated check for incremental sanctions data update

- Operate from a unified case manager

Overview of CORAL™ TradeAML

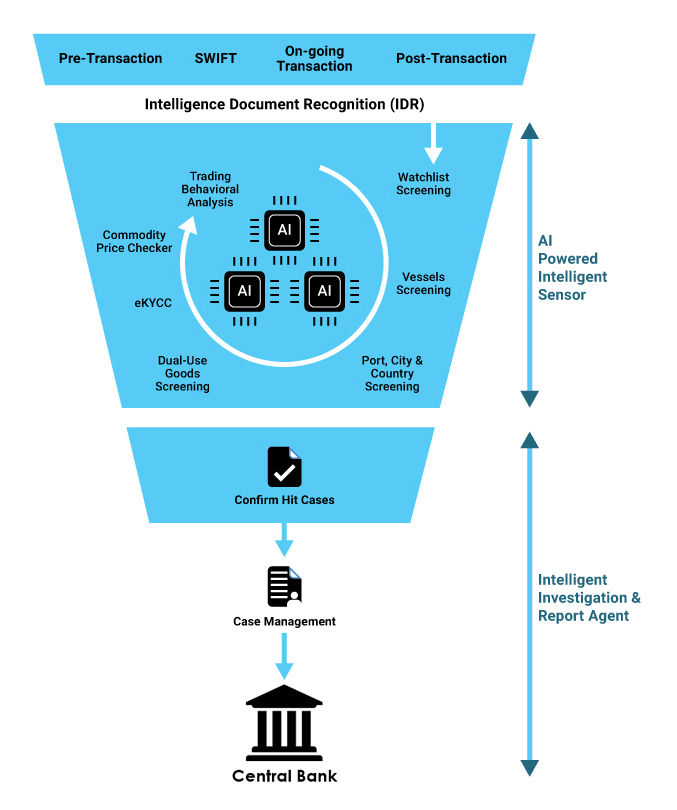

CORAL™ TradeAML enable monitoring of whole trade transaction cycle in various stages, started from pre-transaction where all trading documents are screened, SWIFT transaction whenever a Letter of Credit is involved, on-going transaction that monitors live trading process, and post-transaction where all trades history are consolidated for trading behaviour and pattern analysis. CORAL™ TradeAML utilised document preparation tools – SmartDoc, then passing all information in documents to AI-powered Intelligent Sensor for intelligent screening, filtering and funnelling to finalise the confirmed suspicious trading and ended up to Intelligent Investigation and Reporting Agent for further investigation within the Financial Institution and report to local regulatory authority, Central Bank.

Key Features

CORAL™ TradeAML is an industry-specific solution that supports various stakeholders in the trade finance domain to achieve regulatory compliance through artificial intelligence coupled with an intelligent alert reporting mechanism which entails of:

Know Your Customer (KYC) Watchlist Screening

Vessels Screening & Movement Tracking

Port, City and Country Screening

Dual-Use Goods (DUG) Screening

Know Your Customers’ Customer (KYCC) Screening

Commodity Price Checker

Red Flag Checklist

Workflow & Case Management

SmartDoc

An intelligent Letter of Credit Issuance & Document Preparation tools that captures information from trade documents, allow data to be integrated for compliance check, credit check and even back feeding data to Trade Processing System for transaction booking.

Intelligent Sensor

A detection agent – AI powered intelligent agent system that is capable of handling complex nested group rules execution, executing rule based expert system and risk-based scoring system for probabilistic detection on trade-based money laundering and transaction behaviour profiling.

Agent Integrator

A built-in a complete integrated engine which enables integration with any sanction list and watchlists service providers, legacy core banking systems and various third-party host systems using XML, text or other open standard protocol. It has (3) key features:

- TESS “in-house” Enhanced Watchlist Engine (EWE) to screen vessel, DUG, port and city, developed with machine learning algorithms to reduce false hit rate(s).

- Capability to monitor transaction with machine learning algorithms to increase maximum likelihood such as commodity pricing checking that is close to market pricing.

- Setting up the historical trade monitoring, enhanced customer due diligence (ECDD) and trade documents matching as a final round for suspicious transaction detection.

Investigation & Reporting Agent

Utilises AI techniques to learn the behavior of officers in making investigation-based decisions. When there is a suspicious transaction detected from Intelligent Sensor, it will route to the Investigation Unit as an alert for further analysis through the flexible workflow and case management system. With the enterprise alert system, the user will be able to configure the notification message via Email or SMS to notify the corresponding officer on task(s) that requires attention. It allows various types of management and regulatory reports in any formats to be generated automatically.

Discover How & What TESS Can Do For You

Talk to our professionals on your challenges, we would assists you with a trusted solution.

Reinventing Banking

Through Innovation

- CORPORATE

- About TESS

- Career

- Contact Us

- INSIGHTS

- News Release

- Blog

© 2023 TESS INTERNATIONAL. All rights reserved.