Country Report Summary

Kenya

Anti Money Laundering

FATF status

Kenya is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Latest FATF Statement - 21 February 2025

Since February 2024, when Kenya made a high-level political commitment to work with the FATF and ESAAMLG to strengthen the effectiveness of its AML/CFT regime, Kenya has taken steps towards improving its AML/CFT regime, including by completing a TF risk assessment and by bringing its TFS framework related to proliferation financing into compliance. Kenya should continue to work to implement its FATF action plan to address its strategic deficiencies, including by:(1) presenting the results of the NRA and other risk assessments in a consistent manner to competent authorities and the private sector and updating the national AML/CFT strategies; (2) improving risk-based AML/CFT supervision of FIs and DNFBPs and adopting a legal framework for the licensing and supervision of VASPs; (3) enhancing the understanding of preventive measures by FIs and DNFBPs, including to increase STR filing and implement TFS without delay; (4) designating an authority for the regulation of trusts and collection of accurate and up-to-date beneficial ownership information and implementing remedial actions for breaches of compliance with transparency requirements for legal persons and arrangements; (5) improving the use and quality of financial intelligence products; (6) increasing ML and TF investigations and prosecutions in line with risks; (7) bringing the TFS framework in compliance with R.6 and ensure its effective implementation; and (8) revising the framework for NPO regulation and oversight to ensure that mitigating measures are risk-based and do not disrupt or discourage legitimate NPO activity.

Compliance with FATF Recommendations

The latest follow-up Mutual Evaluation relating to the implementation of anti-money laundering and counter-terrorist financing standards in Kenya was undertaken in 2024. According to that Evaluation, Kenya was deemed Compliant for 19 and Largely Compliant for 9 of the FATF 40 Recommendations. It remains Highly Effective for 0 and Substantially Effective for 0 of the Effectiveness ratings.

Sanctions

There are no international sanctions currently in force against this country.

Bribery & Corruption

Rating: 0 (bad) - 100 (good)

Transparency International Corruption Index = 32

World Bank: Control of Corruption Percentile Rank = 24

Kenya’s corruption levels remain high, as reflected in its 2023 Global Corruption Perception Index ranking of 126 out of 180 countries, a decline from the previous year. Despite some legal frameworks and efforts by the Ethics and Anti-Corruption Commission, successful prosecutions of high-profile cases have been limited, and corruption continues to hinder foreign direct investment. The government’s inconsistent enforcement of anti-corruption laws and the prevalence of bribery in public procurement further exacerbate the issue, undermining economic growth and investor confidence.

Economy

Kenya’s economy demonstrated resilience in 2023, achieving a GDP growth rate of over 5% despite challenges such as high public debt and inflation. The government is focused on attracting foreign direct investment through reforms and initiatives like the Bottom-Up Economic Transformation Agenda, which emphasizes sectors such as agriculture and digital technology. However, bureaucratic hurdles and a high corruption perception continue to pose challenges for U.S. businesses operating in the country.

Kenya has a positive investment climate that attracts international firms, bolstered by the Ruto administration’s focus on foreign direct investment (FDI) and supportive policies for U.S. investment. Despite ongoing tax and regulatory reforms aimed at enhancing the investment environment, challenges such as bureaucratic delays and a relatively low ranking in the Global Corruption Perception Index persist, creating uncertainty for U.S. businesses operating in the country.

Country Report Summary

Malaysia

Malaysia is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Singapore

Singapore is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

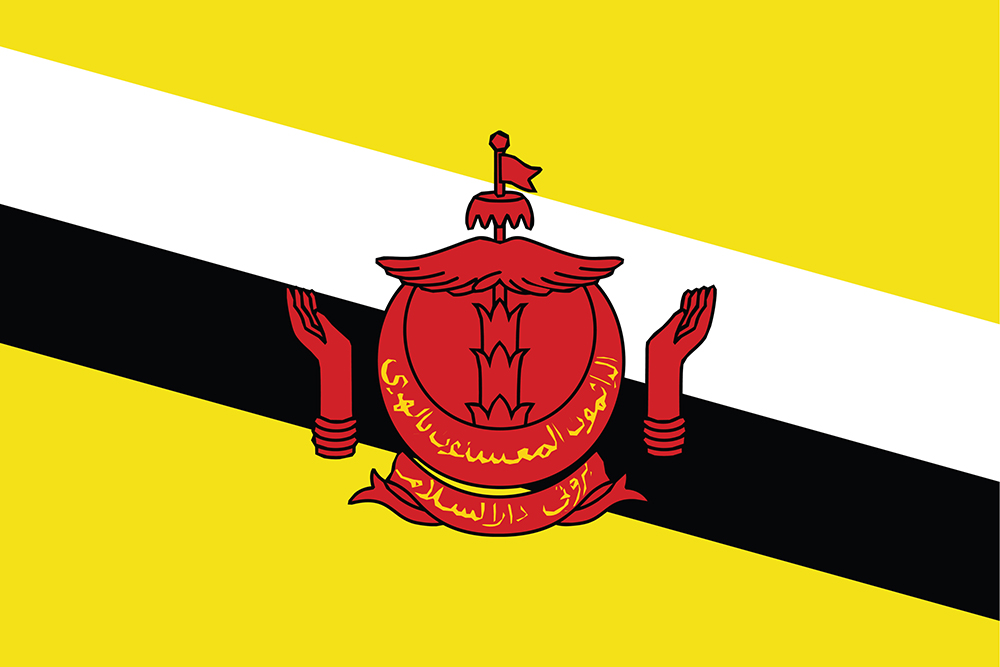

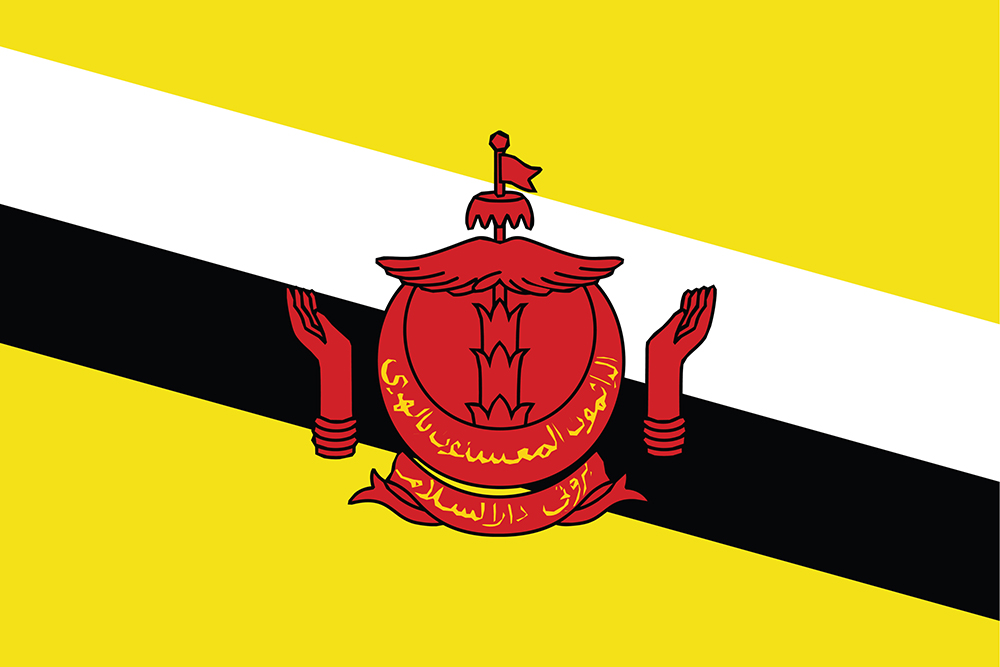

Brunei

Brunei is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Laos

Laos is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Philippines

Brunei is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Cambodia

Cambodia is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Vietnam

Vietnam is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Myanmar

Myanmar is subject to a FATF call on its members and other jurisdictions to apply enhanced due diligence measures proportionate to the risks arising from the jurisdiction.

Timor-Leste

Timor-Leste is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Thailand

Thailand is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Indonesia

Indonesia was removed from the FATF List of Countries that have been identified as having strategic AML deficiencies on 26 June 2015.

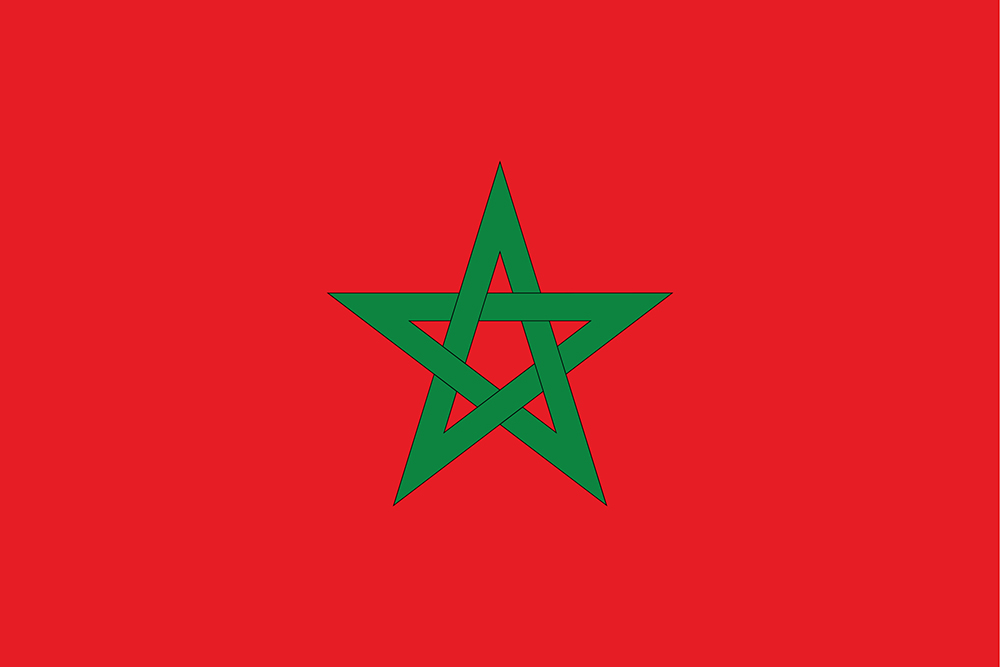

Morocco

Morocco is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Tanzania

Tanzania is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Kenya

Kenya is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Rwanda

Rwanda is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

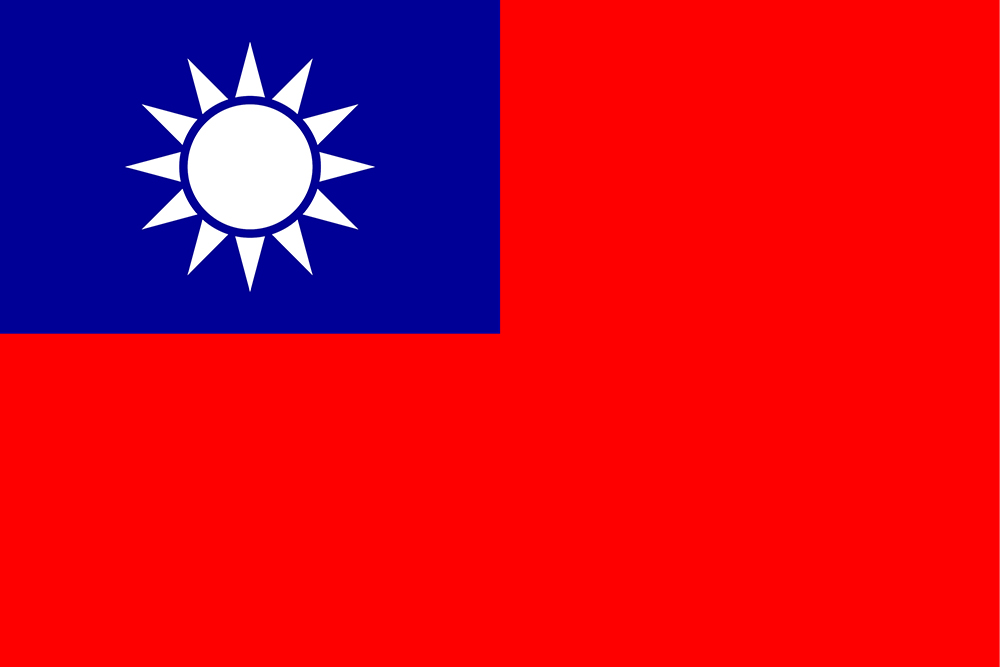

Taiwan

Taiwan is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Hong Kong

Hong Kong is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.