Country Report Summary

Philippines

Anti Money Laundering

FATF status

The Philippines are no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Latest FATF Statement - 21 February 2025

The FATF welcomes the Philippines’ significant progress in improving its AML/CFT regime. The Philippines strengthened the effectiveness of its AML/CFT regime to meet the commitments in its action plan regarding the strategic deficiencies that the FATF identified in June 2021 by (1) demonstrating that effective risk-based supervision of DNFBPs is occurring; (2) demonstrating that supervisors are using AML/CFT controls to mitigate risks associated with casino junkets; (3) implementing the new registration requirements for MVTS and applying sanctions to unregistered and illegal remittance operators; (4) enhancing and streamlining LEA access to BO information and taking steps to ensure that BO information is accurate and up-to-date; (5) demonstrating an increase in the use of financial intelligence and an increase in ML investigations and prosecutions in line with risk; (6) demonstrating an increase in the identification, investigation and prosecution of TF cases; (7) demonstrating that appropriate measures are taken with respect to the NPO sector (including unregistered NPOs) without disrupting legitimate NPO activity; (8) enhancing the effectiveness of the targeted financial sanctions framework for both TF and PF; and (9) applying cross-border measures in all main international sea/airports, in line with the risk.

The Philippines should continue to work with APG to sustain its improvements in its AML/CFT system. The FATF encourages the Philippines to continue its work in ensuring that its CFT measures are appropriately applied, particularly the identification and prosecution of TF cases, and are neither discouraging nor disrupting legitimate NPO activity.

Compliance with FATF Recommendations

The last follow up Mutual Evaluation Report relating to the implementation of anti-money laundering and counter-terrorist financing standards in the Philippines was undertaken in 2022. According to that Evaluation, the Philippines was deemed Compliant for 8 and Largely Compliant for 29 of the FATF 40 Recommendations. It remains Highly Effective for 0 and Substantially Effective for 1 with regard to the 11 areas of Effectiveness of its AML/CFT Regime.

Sanctions

There are no international sanctions currently in force against this country.

Bribery & Corruption

Rating: 0 (bad) - 100 (good)

Transparency International Corruption Index = 33

World Bank: Control of Corruption Percentile Rank = 33

Corruption remains a significant issue in the Philippines, with the country ranking 117th in Transparency International’s 2021 Corruption Perceptions Index, its lowest score in nine years. The government has initiated measures to combat corruption, including the establishment of the Presidential Complaint Center and various anti-corruption laws, but challenges persist due to limited convictions and a weak enforcement framework. Corruption particularly affects business operations, with extensive bribery and complex regulations creating an uncertain environment for both local and foreign companies.

Economy

The Philippines is focused on enhancing its investment climate and recovering from the impacts of the COVID-19 pandemic, with sovereign credit ratings remaining at investment grade despite concerns over rising public debt and inflation. Foreign direct investment (FDI) inflows have rebounded significantly, reaching USD 10.5 billion in 2021, although the country still lags behind its ASEAN peers in attracting FDI over the past decade. Key sectors attracting investment include manufacturing, energy, financial services, and real estate, while challenges such as poor infrastructure, high costs, and regulatory inconsistencies continue to hinder further growth.

The investment climate in the Philippines is characterized by a commitment to improving foreign direct investment (FDI) inflows, which rebounded to USD 10.5 billion in 2021, surpassing pre-pandemic levels. However, challenges such as poor infrastructure, high costs, regulatory inconsistencies, and corruption continue to deter foreign investors, with the country lagging behind its ASEAN peers in attracting FDI. Recent legislative amendments have aimed to open up sectors to greater foreign ownership and reduce barriers, but concerns about public debt and inflationary pressures remain.

Country Report Summary

Malaysia

Malaysia is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Singapore

Singapore is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

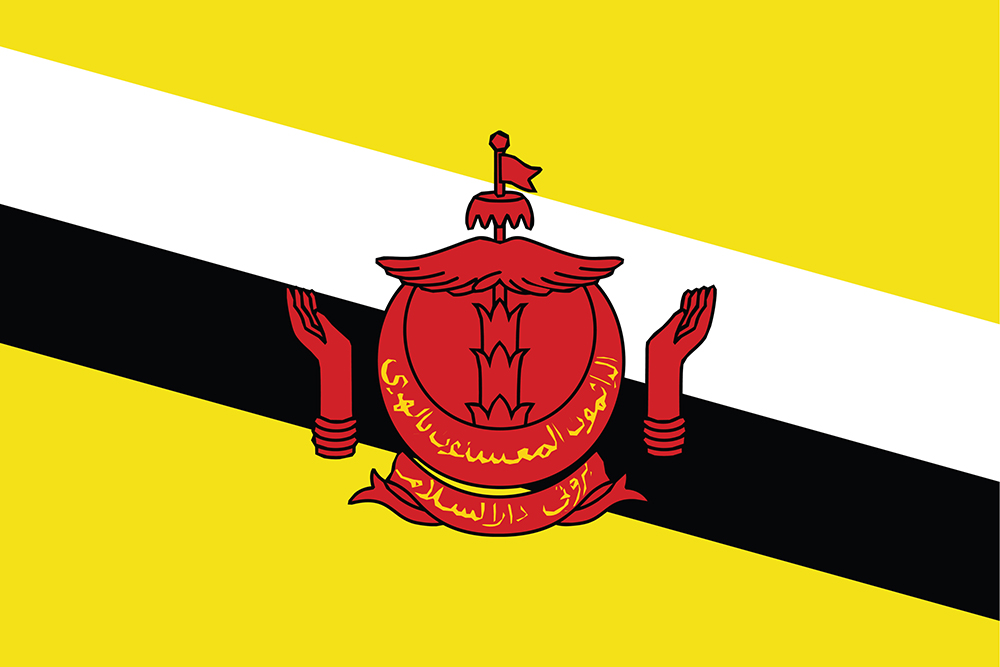

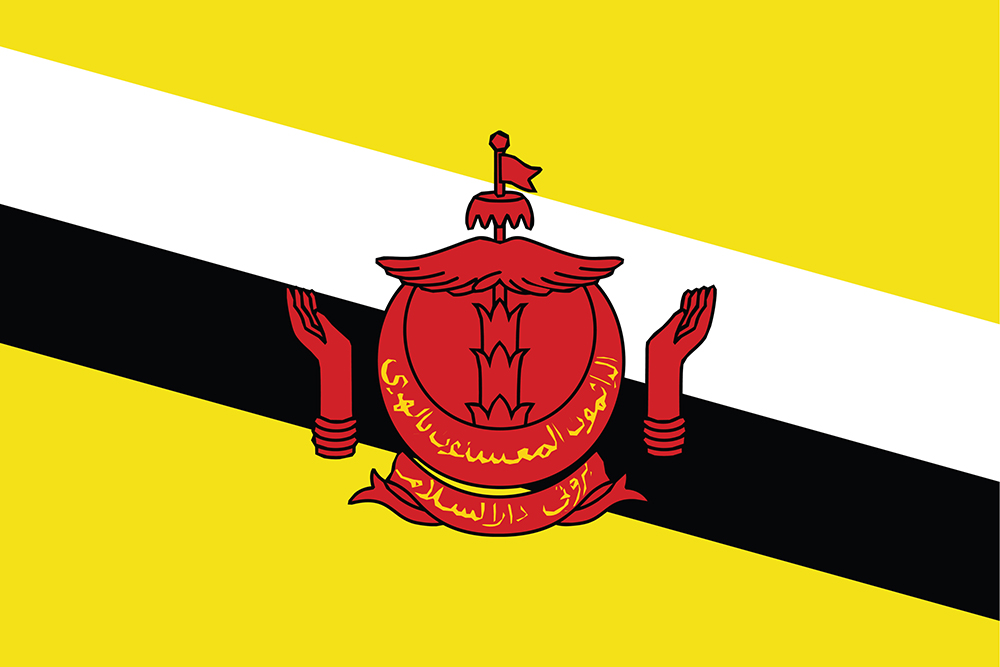

Brunei

Brunei is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Laos

Laos is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Philippines

Brunei is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Cambodia

Cambodia is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Vietnam

Vietnam is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Myanmar

Myanmar is subject to a FATF call on its members and other jurisdictions to apply enhanced due diligence measures proportionate to the risks arising from the jurisdiction.

Timor-Leste

Timor-Leste is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Thailand

Thailand is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Indonesia

Indonesia was removed from the FATF List of Countries that have been identified as having strategic AML deficiencies on 26 June 2015.

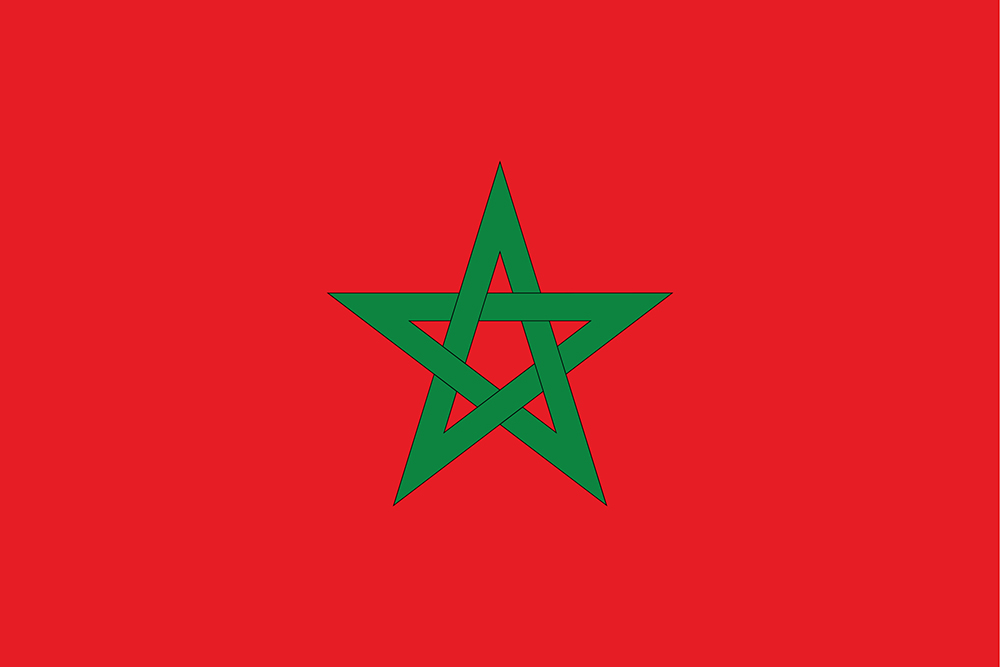

Morocco

Morocco is no longer on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Tanzania

Tanzania is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Kenya

Kenya is on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Rwanda

Rwanda is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

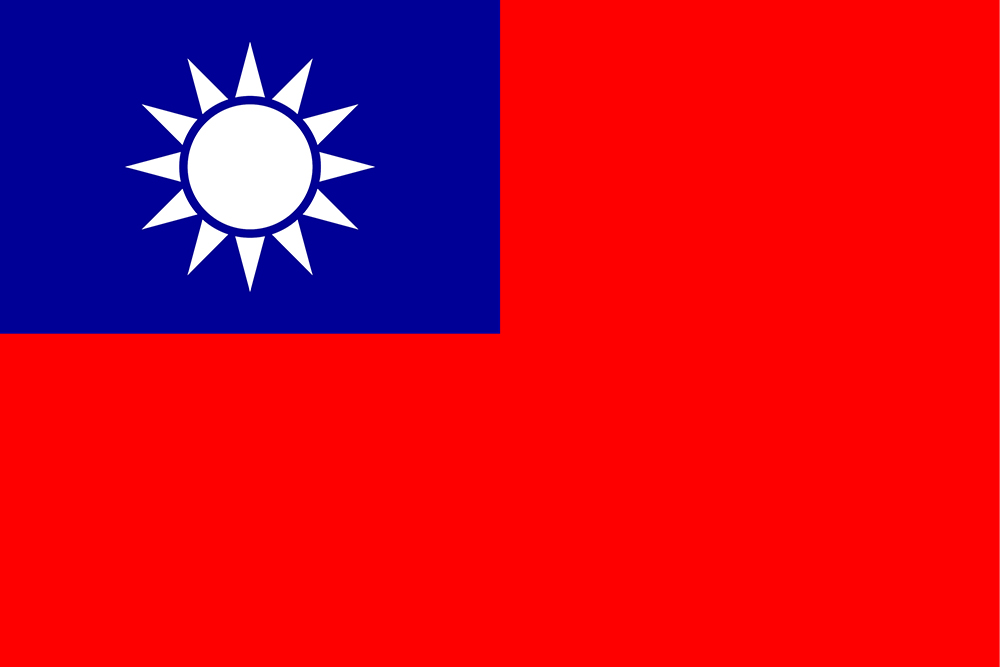

Taiwan

Taiwan is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.

Hong Kong

Hong Kong is not on the FATF List of Countries that have been identified as having strategic AML deficiencies.